Press Release: 12/30/2025

NCLC’s Year in Economic Justice: 2025

December 29, 2025

2025 ushered in significant change in consumer laws and regulations. NCLC advocates responded rapidly to resist rollbacks of federal consumer protections and to increase state-level protections. Through strategic advocacy and litigation, they took action to protect low-income consumers threatened by record-breaking personal debt and a growing affordability crisis.

Consumer Financial Protection Bureau

In February, NCLC joined a lawsuit as a plaintiff to challenge the unlawful dismantling of the Consumer Financial Protection Bureau (CFPB). Along with the NAACP, the Virginia Poverty Law Center, an individual plaintiff, and the CFPB Employee Association, NCLC is seeking to stop the CFPB’s Acting Director Russell Vought from carrying out mass firings of CFPB staff, directing the CFPB to cease work, cancelling contracts and otherwise suspending the operations of the CFPB. The U.S. District Court paused mass layoffs at the CFPB. The case is on appeal in the U.S. Court of Appeals for the D.C. Circuit, where the court granted an en banc review.

To protect CFPB funding, NCLC and our allies worked with Sen. Elizabeth Warren to fight the proposal to eliminate all the CFPB’s funding in the budget reconciliation bill. While future CFPB funding was cut by 47%, it was nonetheless an important victory to ensure some remaining funding.

NCLC advocates provided important analysis of the effect of the CFPB’s withdrawal of dozens of guidance documents. Many of these guidance documents have significant utility in consumer litigation involving: the Fair Credit Reporting Act; Federal Debt Collection Practices Act; Truth in Lending Act; Equal Credit Opportunity Act; state Unfair, Deceptive and Abusive Acts and Practices statutes; and other consumer credit laws. A Digital Library article – viewed by more than 1,250 people on the first day it was released – explains how consumer law practitioners can continue to use these withdrawn interpretations in consumer litigation.

NCLC joined lawmakers at the podium for a February rally in support of the CFPB, and in March, NCLC joined hundreds of consumer advocates and concerned voters from 45 states and D.C. for scheduled meetings with lawmakers to urge them to support a strong and independent CFPB. More than 75 law professors also sent a letter urging the Administration to allow the CFPB to return to its mission to protect consumers.

NCLC’s advocacy and coalition work in California helped lead to the passage of the California CARS Act, which requires car dealers to disclose the “total price” up front and in advertising and prohibits dealers from selling worthless add-on products. The act will protect millions of Californians from costly auto sales scams and NCLC encourages state legislatures across the nation to act to protect auto buyers.

NCLC and a coalition of consumer groups urged the Consumer Financial Protection Bureau (CFPB) to reject a plan to reduce the number of participants in the auto finance market that are subject to supervision by the CFPB. Instead of reducing the number of entities it can supervise, advocates urged the Bureau to consider expanding the rule to ensure it is able to supervise larger participants in different categories such as subprime finance companies and Buy Here Pay Here Dealers.

Banking, Payments, Fraud & Remittances

NCLC fought hard to preserve the CFPB’s 2024 rule that would have capped most overdraft fees at $5. We represented two organizations that were granted leave to intervene in the banking industry lawsuit challenging the rule and fought with our allies to oppose a congressional resolution to overturn the rule. We highlighted the impact on military families and the largest overdraft fee offenders. While Congress did approve the resolution and President Trump signed it, the effort raised awareness about the problems with overdraft fees and resulted in bipartisan support for overdraft fee reform.

We also highlighted the problems with overdraft fees in testimony to the Senate Committee on Banking, Housing, and Urban Affairs Hearing on the impacts debanking in America. A top reason that people are or become unbanked is high fees, and in particular, high, snowballing overdraft fees. Overdraft fees can be a significant source of profit for banks.

At another hearing, with financial fraud continuing to pose a threat to U.S. households, Carla Sanchez-Adams testified before the Oversight and Investigations Subcommittee of the House Financial Services Committee on how to increase protections for consumers. The ease and use of mobile and online banking through technological advancement have provided new opportunities for scammers to exploit newer payment technologies, advocates warned.

An issue brief highlights strategies to prevent payment fraud and keep the banking and payment system safe and provides recommendations to address the current gaps and ambiguities in the Electronic Fund Transfer Act (EFTA) that leave fraud victims unprotected. NCLC also submitted comments to the banking agencies on payment fraud and participated in a broad industry-consumer task force to urge a new national strategy to prevent fraud.

Advocates fought a congressional resolution to overturn a CFPB rule allowing it to oversee the largest big tech payments apps, but Congress overturned the rule. Advocates opposed a separate potential rule cutting back on the CFPB’s supervision of the remittance industry and others. No final action in that area has yet been taken.

Consumer Protections for Tenants

The housing crisis for low- and moderate-income renters continues. Contributing to these woes are questionable tenant screening reports, abusive collection of rental debt, imposition of junk fees, and the proliferation of predatory RentTech, such as security deposit replacement scams and rent-splitting products. For that reason, NCLC advocates issued a slate of consumer reform priorities to help struggling renters obtain and keep safe, decent, and affordable housing.

NCLC updated its report, “What the Heck, Dude!”: How States Can Fight Rental Housing Junk Fees, which shows how state and local governments are passing laws and using litigation to stop predatory rental housing junk fees, which have been costing renters across the country hundreds of millions of dollars per year and pushing safe, affordable, and sustainable housing out of reach.

Advocates produced a policy brief to inform state lawmakers of the actions they can take to regulate tenant screening, including avoiding possible federal preemption and potential administrative agency action.

Ariel Nelson, senior attorney at NCLC, offered testimony on bills that would help rein in rental housing junk fees in Oregon, New Mexico, and Massachusetts. She also participated in a press conference with the Massachusetts Attorney General announcing the state’s new junk fees regulations, which apply to rental housing.

Advocates sent a letter to the Massachusetts Budget Conference Committee urging the adoption of a rule that bans the practice of requiring tenants to pay broker fees for rental units where the broker was hired by the landlord.

Advocates also co-organized and led a policy sprint called Unlocked: Opening the Door to Housing Access Through Tenant Screening Protections which provided teams of advocates and policymakers from different jurisdictions with an 8-week learning series focusing on tenant screening protections that prevent housing discrimination and exclusion.

Credit Reporting & Data Fairness

Advocates formed a quick and comprehensive response to the Trump Administration’s CFPB issuing guidance claiming to prohibit states from removing medical debt from people’s credit reports. Advocates identified the guidance as “internally contradictory” and “not legally binding.”

NCLC provided recommendations for what states can do to prevent medical debt from ruining credit reports, including suggestions that will help “preemption proof” state laws prohibiting medical debt credit reporting.

NCLC Director of Consumer Reporting and Data Advocacy Chi Chi Wu submitted testimony in support of a Massachusetts bill to ban the use of credit reports and scores for tenants who have a government rent subsidy.

See more about medical debt and credit reports in the Medical Debt section.

A new NCLC report, Seizing the Safety Net: Collecting Criminal Justice Debt with Tax Refund Offsets, examines one little-known method of collecting criminal justice debt—seizing income tax refunds—and highlights the financial harms for justice-involved individuals and their families when the government seizes the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) as part of that tax refund. A follow-up issue brief, What States Can Do to Protect Low-Income Families When Collecting Government Debts, explains how states can protect recipients of state EITC and CTC benefits.

In another issue brief, Robbed Behind Bars: Identity Theft Committed Against Incarcerated Victims, NCLC advocates address a surprising fact: identity theft is a major problem for incarcerated people.

Seizing family inheritances to pay for incarceration causes particular harm to Black communities, and an issue brief from NCLC highlights state policymakers’ important role in reforming the laws that sentence formerly incarcerated people and their families to generations of debt. Handcuffing Heirs: How Seizing Inheritances to Collect Pay-to-Stay Prison Fees Hinders Recovery and Financial Stability provides recommendations to state lawmakers on how to end or alleviate the punishing impact of pay-to-stay fees.

NCLC is representing a group of incarcerated consumers and their loved ones who purchase food from Aramark Corporation’s correctional services in a class action lawsuit challenging Aramark’s scheme to unfairly profit off them. They allege that Aramark—which holds the contract for all food provisions offered in West Virginia correctional facilities—drives them to purchase food from the commissary by failing to provide adequate free daily meals. “Food is a uniquely powerful tool, and Aramark is using it to exploit a captive consumer market of incarcerated people and their families to unlawfully profit off them,” said Shennan Kavanagh, director of litigation at the National Consumer Law Center. NCLC partnered with Mountain State Justice and Relman Colfax PLLC to bring the litigation.

NCLC is co-leading a coalition advocating to end debt-based driving restrictions in Massachusetts. NCLC played a key role in organizing a legislative briefing on the bill in May, and NCLC Staff Attorney Caroline Cohn testified at a hearing before the Massachusetts Joint Committee on Transportation in July.

Caroline Cohn also submitted testimony to the Colorado Senate Judiciary Committee in support of legislation that would eliminate medical copayments for incarcerated people.

The report, Disregarded and In Debt: Understanding Barriers to Relief for Victims of Coerced Debt, examines coerced debt, which occurs when an abuser either fraudulently opens accounts—like credit cards or loans—in the victim’s name or coerces the victim into taking on debt they would not have otherwise obtained. The report provides a summary of the results of a survey of state-based advocates and highlights the greatest barriers victims of coerced debt face in getting relief. The survey was also used to provide comments to the CFPB after it granted NCLC and CSAJ’s petition for rulemaking regarding the Fair Credit Reporting Act, identity theft, and coerced debt. Finally, NCLC advocates assisted various state coalitions in Illinois, Nevada, and New York who passed legislation prohibiting the collection of coerced debt.

NCLC filed comments with the CFPB to oppose reducing the number of debt collectors subject to supervision from 250 to as few as 11.

NCLC’s annual No Fresh Start report analyzed state exemption laws, which protect income and property from seizure by creditors, debt buyers, and the debt collectors they hire, are a fundamental safeguard for families. No state received an ‘A’ grade, and the report offered a serious of recommendations for best practices for state exemption laws to allow families to retain a living wage, a family car, and other assets to prevent them from falling deeper into poverty.

NCLC provided analysis of important new bankruptcy protections that went into effect on December 1, which incorporate suggestions made by NCLC in comments provided to the Advisory Committee on Bankruptcy Rules. A bankruptcy chapter 13 plan is one of the most effective ways to stop a foreclosure and keep struggling homeowners current on their mortgages, and the new changes offer homeowners significant new rights in protecting their home in a chapter 13 bankruptcy. The analysis explained eight ways that the new bankruptcy rule amendments protect homeowners in bankruptcy, and the practical implications of those improvements for homeowners.

NCLC Senior Attorney Andrea Bopp Stark testified before the Massachusetts Legislative Committee of the Judiciary in Support of H1694/ S1147 — An Act Providing Civil Legal Remedies for Victims of Economic Abuse. The bill establishes a legal process for victims of coerced debt, including survivors of domestic abuse, to find relief and restore their credit.

Advocates provided testimony against a Washington State debt adjustment bill that would substantially weaken Washington’s protections against unfair debt adjustment (debt settlement) services.

Energy, Utilities, & Telecommunications

Energy affordability became an even greater concern in 2025, as customers saw their utility bills rise due to a number of factors including the price of natural gas, the increasing electricity needs of data centers, the need to repair and rebuild energy infrastructure after wildfires and other disasters, and more. NCLC is focused on helping those with the greatest financial need to stay connected to essential utility service, and to have fair access to new energy technologies such as energy efficiency improvements and heat pumps.

In Illinois, we helped utility consumers by proposing a new discounted rate affordability program, which was adopted by the Illinois Commerce Commission. The program will ensure that income-eligible customers pay no more than 3% of their monthly income toward electricity bills. Known as a Percentage of Income Payment Plan or “PIPP”, it ensures that enrolled customers’ monthly bills won’t increase even when rates or customers’ usage increase. The 3% percentage figure is a nationally recognized measure of energy affordability.

NCLC advocates also won a protection from utility disconnections in Massachusetts during the government shutdown. The temporary disconnection moratorium protected low-income consumers who would normally receive LIHEAP benefits but were not able to because of the shutdown. Advocates in other states have looked to this protection as a model.

NCLC advocates opposed energy financing products that could bring financial harm to low-income families at a time when energy bills are rising across the country. In several states, including California, Colorado, Illinois and Massachusetts, NCLC worked with state advocacy partners to educate policymakers about the potential risks of on-bill energy financing products, and pushed to eliminate the most harmful aspects of these products.

NCLC, because of our independence from federal funds, was able to come out early in objection to the firing of the LIHEAP and weatherization staff, to raise the urgent need for the release of the remaining 10% of the FY 2025 funds, and to advocate for funding and a strong LIHEAP program. We played a pivotal role in helping build momentum across a wide range of organizations. Currently, the remaining weatherization money has been released, and we believe the remaining LIHEAP money will also be released–a far cry from where we were in February.

In March, when the Trump administration first launched its all-out assault on equity, civil rights, racial justice, and the rule of law, advocates urged immediate action from state lawmakers and advocates to create a “firewall against the erosion of civil rights on the federal level.”

Advocates were poised to push back the following month, when the President issued an order that would widen the racial wealth gap. The order would stop agencies from using data to identify discriminatory policies and practices that disproportionately harm certain groups, known as “disparate impact.” Instead, the government would only address illegal discrimination in the rare instances when the bad actor is caught red-handed.

And in November, when the Trump Administration’s CFPB issued a proposed rule gutting fair lending protections under the Equal Credit Opportunity Act (ECOA), NCLC advocates organized opposition, creating a web portal to submit comments directly to Russell Vought, acting director of the CFPB, a fact sheet explaining the proposal and its impact, and submitting comments on behalf of NCLC and low-income consumers. The comments highlight the devastating blow the elimination of ECOA protections would deal to the many groups of people who have been discriminated against when they tried to get credit, including to buy a car or house or start a small business. Black people, Latinos, Native Americans, servicemembers and veterans, and older adults are among the groups who may find it harder and more expensive to get loans. ECOA was originally passed to ensure that women could get a loan without the approval of their husband or father, and many have expressed concern that women, across all racial groups, may once again find access to credit blocked.

Earlier in the year, advocates submitted comments on the development of an artificial intelligence (AI) action plan, warning the use of artificial intelligence in housing and consumer credit, banking and other critical financial transactions may lead to unlawful discrimination in violation of consumer protection, fair lending and civil rights laws. The action plan, advocates argued, must guard against the systemic risks posed to consumers by the deployment of AI systems.

NCLC joined disability, elder, fellow consumer rights, and other organizations to express concerns regarding proposed cuts to Medicaid and the ACA under the Big Bill Act.

And advocates sent a letter to the Department of Housing and Urban Development (HUD) and the Office of Management and Budget (OMB) urging the agencies to preserve regulations prohibiting “disparate impact” discrimination. Without protections from disparate impact discrimination, many people would be shut out of achieving the American Dream of safe, stable, affordable housing of their choice during a time when the nation faces a fair and affordable housing crisis.

NCLC has been fighting evasions by high-cost lenders and pushing for strong protections for new forms of credit.

NCLC applauded a Tenth Circuit decision that agreed with an amicus brief filed by NCLC and the Center for Responsible Lending and found that predatory out-of-state rent-a-bank lenders charging rates up to 200% can no longer make loans to Colorado consumers following Colorado’s “opt out” legislation. We also submitted testimony supporting a Rhode Island bill that also would prohibit predatory rent-a-bank lending and submitted comments on regulations to implement Washington State’s successful “true lender” bill.

NCLC published issue briefs on the risks of and advice for buy now, pay later loans (BNPL) and the rights that borrowers have after the CFPB rescinded its BNPL interpretive rule. We commented on anticipated BNPL regulations in NY implementing successful legislation we supported. NCLC urged HUD to collect more data before any decisions on the role of BNPL loans in underwriting for FHA mortgages.

Advocates also sounded the alarm over dangers lurking in BNPL and deferred interest credit card offers peddled to holiday shoppers. These loans can make unaffordable purchases look cheaper than they are, and zero interest credit card promotions can be a “risky hidden time bomb.”

NCLC updated our 50-state survey of the maximum annual percentage rates (APR) allowed by states for installment loans of various sizes. We published an issue brief comparing the APRs of payday loans and various small loan alternatives, including earned wage payday loans and credit cards.

NCLC fought against the damaging effects of payday loan apps (so-called “earned wage access products”) that force workers to pay to be paid and are disguised loans that hide interest in access fees and “tips.”

NCLC partnered with two private law firms to sue predatory earned wage payday lender MoneyLion on behalf of a nationwide class of servicemembers and their spouses and a subclass of Florida consumers. MoneyLion offers various products, including “Instacash loans and Credit Builder loans,” at usurious interest rates that are disguised as “Turbo Fees,” “Tips,” and “Monthly Membership Fees.” The complaint alleges that MoneyLion’s conduct violates the Military Lending Act, the Truth in Lending Act, and the Florida usury statute.

NCLC advocates also publicized important data revealed by lawsuits filed by the New York Attorney General against MoneyLion and DailyPay over their violations of New York’s usury laws. An issue brief finalized earlier in the year outlines the tricks cash advance apps use to coerce borrowers into leaving a “tip,” including 17 messages prompting about the importance of tipping and requiring 13 additional clicks to advance without a tip.

We worked with other state and national advocates to defeat or stall 13 state bills pushed by earned wage payday lenders that would have carved loopholes in state protections. Four conservative states that mostly allow payday loans did pass the industry bills, but bills that passed in Connecticut and Maryland, while imperfect, reject the myth that these loans are not loans and include real fee caps.

Homeownership & Foreclosure Prevention

NCLC’s litigation team joined a class action lawsuit seeking nationwide relief from a deceptive home-selling and financing scheme employed by D.R. Horton Inc., the nation’s largest homebuilding company, and its mortgage lending subsidiary, DHI Mortgage Co. The lawsuit alleges that D.R. Horton targets prospective homeowners by promising low, affordable monthly payments, and then works with DHI Mortgage to suppress the actual cost of the home by illegally excluding the majority of required property taxes from the initial monthly payment.

NCLC’s work with mortgage servicers and their trade associations was instrumental in garnering widespread support for a strong post-COVID set of hardship assistance options adopted by the Federal Housing Administration (FHA), originally developed under the Biden administration.

FHA also left in place a new rule – proposed and finalized under the Biden administration in response to long-term advocacy from NCLC– that builds on significant protections for homeowners when their loan notes are sold. A note sale occurs when a homeowner has defaulted on a mortgage and FHA sells the delinquent mortgage note to a third party, often corporate investors. Historically, note sales have resulted in significant numbers of homeowners being deprived of their foreclosure protections and losing their homes.

NCLC advocates were instrumental in addressing a long-standing inequity facing Veterans. Congress approved a bill that will allow VA borrowers (veterans and their families) who fall behind on their payments to have those payments put into a second loan on which no interest accrues, which they pay at the end of the loan. The bill will provide relief to tens of thousands of veterans and their families, and NCLC worked closely with mortgage trade associations and CRL to provide timely and candid technical assistance to both House and Senate staffers, and were available to testify in Congress.

NCLC is calling attention to the dangers of home equity “investment” (HEI) contracts. An issue brief explains that even though they are marketed as innovative, flexible ways for homeowners—especially seniors and those with limited income or credit—to tap their home equity without taking out a loan, these products function like high-cost, high-risk mortgage loans and advocates called for them to be regulated as such. NCLC is working with advocates around the country on state legislation and regulation as well as litigation in this area and has assembled a comprehensive HEI Practice Suite. To support practitioners in Massachusetts, NCLC Senior Attorneys Andrea Bopp Stark and Andrew Pizor produced a fact sheet and provided testimony in support of a bill that would regulate shared appreciation mortgages & home equity “investment” loans by clarifying these products are loans. In addition, NCLC, along with co-counsel, filed litigation in California in September challenging Unison’s “shared equity option” products.

NCLC advocates are growing and supporting the community of practitioners working with owners of manufactured homes, especially those who live on leased land in manufactured housing communities. NCLC rebooted its listserv, joined with the National Housing Law Project to organize regular nationwide calls for local advocates, and established an NCLC resource library for attorneys to share pleadings and other resources.

NCLC represented Tzedek DC, New Mexico Center on Law and Poverty, and two individuals who intervened to defend a CFPB rule that forbid the inclusion of medical bills on credit reports after the federal government stopped defending the rule. While the U.S. District Court in the Eastern District ultimately overturned the CFPB rule, NCLC has continued to support state advocacy to prohibit medical credit reporting with resources such as What States Can Do to Prevent Medical Debt from Ruining Credit Reports: Recommendations in the Face of Potential Federal Preemption Threats, What the CFPB’s Recent FCRA Preemption Guidance Gets Wrong, and The Latest on Keeping Medical Debt Out of Credit Reports.

NCLC’s work and technical expertise helped ensure the passage of new state laws prohibiting the credit reporting of medical debt. There are now protections in 15 states: California, Connecticut, Colorado, Delaware, Illinois, Maine, Maryland, Minnesota, New Jersey, New York, Oregon, Rhode Island, Vermont, Virginia, and Washington.

NCLC’s Model Medical Debt Protection Act, now in its third edition, is a tool for advocates who are working to protect consumers who are burdened with medical debt in their states. The model act provides suggested language to improve state health care financial assistance laws, and to strengthen medical debt collection consumer protections. What States Can Do to Help Consumers: Medical Debt, updated earlier this year, discusses general protections states should consider passing, including prohibiting aggressive debt collection practices and strengthening hospital financial assistance.

Medical bills often end up on credit cards, including medical credit cards and other medical lending products. What States Can Do: Medical Credit Cards and Other Medical Lending Products discusses the options that states have to protect their consumers.

Another issue brief, What States Can Do About Medical Debt in Jails and Prisons, looks at the various fees, such as medical co-pays, emergency fees, prescription co-pays, medical device fees, and fees for necessary hygiene items charged by many jails and prisons. Advocates discuss the problems caused by these fees and propose state solutions.

NCLC Senior Attorney Berneta Haynes testified before the Maryland House Health & Government Operations Committee in support of a bill to create consistent guidelines and discounts for patients seeking to access financial assistance, expand eligibility for financial hardship assistance, prohibit reporting of hospital medical debt to credit reporting agencies, and ban hospital lawsuits for medical debt of $500 or less.

In December, NCLC Senior Attorney Berneta Haynes also provided written testimony in support of the District of Columbia’s Medical Debt Mitigation Amendment Act of 2025, which would ban reporting of medical debts to credit reports, strengthen hospital financial assistance by requiring screening, and more. NCLC Senior Attorney Chi Chi Wu also testified in support of the bill before the Committee on Health.

When critical consumer protections from unwanted and harmful robocalls and texts were threatened, NCLC advocates answered the call. In October, the FCC proposed deleting two Telephone Consumer Protection Act (TCPA) regulations that provide important protections for consumers and small business owners from telemarketing and other unwanted robocalls. Advocates quickly sent a letterto FCC Chairman Brendan Carr urging the Commission to reverse its proposal and issued two press releases, one digging into the issuefor a more technical telecom reporter audience and another for a broader, consumer-focused audience, warning that the new rules could make robocalls impossible to stop. After receiving backlash in the press, including from some unlikely allies that defend robocallers in court, on October 29, the FCC walked back its plan to strip people of the critical right to tell telemarketers and robocallers to “stop calling”

Earlier in the year, small business owners and consumer advocates stepped up to try to save a popular anti-robocall rule when they asked the U.S. Court of Appeals for the Eleventh Circuit for permission to intervene to request a rehearing after it issued a decision to overturn a Federal Communications Commission (FCC) rule drafted to fight the nation’s robocall epidemic, known as the “one-to-one consent” rule. Public Justice and NCLC represented the proposed intervenors. The Trump administration’s FCC opposed intervention and declined to further defend the rule ensuring its repeal.

And in September, advocates produced an issue brief, Strategies for Reducing Scam Calls and Texts by Holding Providers Accountable, identifying strategies that would reduce or even eliminate harmful scam calls, including by holding the VoIP providers liable for their failure to police their own businesses. The brief provided recommendations for state and federal legislation and FCC regulations.

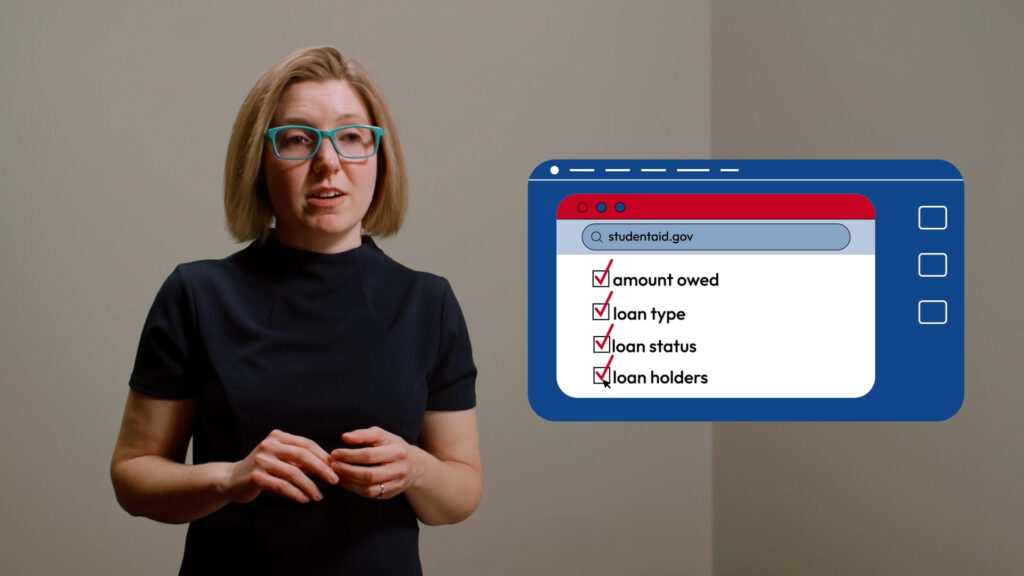

NCLC’s student loan experts produced a series of student loan videos designed for borrowers struggling to navigate the student loan repayment process. The videos aim to help borrowers manage their student loans. With repayment underway, temporary relief programs over, the most affordable payment plan blocked, and collections restarted, as many of 10 million borrowers are in or will soon be in default.

NCLC is helping borrowers negotiate sudden changes to federal student loan programs, including a likely abrupt end to the SAVE program, which offered millions of federal student loan borrowers lower monthly payments and a pathway to becoming debt free, and a new rule that could kick many borrowers out of the Public Service Loan Forgiveness Program.

Advocates are also sounding the alarm that the government is beginning to seize tax refunds from borrowers in default for the first time since 2020. It can even take refunds that include thousands of dollars of Child Tax Credits and Earned Income Tax Credits — financial lifelines for working families. NCLC is coordinating a new campaign encouraging borrowers to Dial Before You File to ensure their anticipated refunds won’t be lost.

We participated as a member of one negotiated rulemaking at the Department of Education, and supported legal aid attorneys representing low-income borrowers in a second rulemaking. The first rulemaking–a rushed and compressed process, happening over three days instead of a more typical three months–was meant to provide a basis for denying public service student loan forgiveness to people that work for organizations or state or local governments that fail a political litmus test on hot button issues including gender-affirming care, civil rights, and immigration. Because of our relative independence, we were able to be a strong voice against politicizing public service rules. In the second rulemaking, NCLC helped legal aid members of the rulemaking committee to identify, advocate for, and secure changes to proposed repayment rules to make repayment more affordable, fair, and manageable for low-income borrowers.

Awards/Recognition

Several NCLC advocates received national recognition in 2025 for their outstanding careers advancing consumer protections.

The Consumer Federation of America presented Associate Director Lauren Saunders with its highest advocacy award, the Esther Peterson Consumer Service Award, in recognition of her extraordinary advocacy on behalf of consumers. Will Ogburn, NCLC Senior Fellow presented the award, noting that Lauren’s federal advocacy has created meaningful protections for consumers, including shielding active duty servicemembers and their families from predatory lending practices.

Charlie Harak received NEUAC’s Sister Pat Kelley Achievement Award, presented by NCLC senior attorney Olivia Wein. Named for the St. Louis nun who founded the national effort to advocate for energy assistance for vulnerable households, this award recognizes a person with exemplary achievement in increasing public awareness of access issues related to heating and cooling, advancing energy assistance policy, and promoting charitable energy assistance.

Berneta Haynes was awarded with the Health Award at 2025 Health Action Conference because of her medical debt advocacy focused on the impact on low-income earners and people of color. Each year during the Health Action Conference, Families USA honors state and community leaders who are advancing health and economic justice through advocacy. These awards reflect Families USA’s four pillars: Health Equity, Health Care Value, Coverage, and People’s Experience.